About Arch Legacy Firm

At Arch Legacy Firm, we are a boutique estate planning firm and team of moms protecting your family now and after you’re gone. We are devoted to helping families & professionals protect their loved ones, business, and assets with personalized estate planning and business planning.

We help ensure that entrepreneurs can build and protect the business of their dreams with our advanced business planning and consulting. We have created a one stop shop for all business owners and professionals who want a team to help them grow their legacy and protect their legacy for life.

With our comprehensive Kid’s Protection Plan, parents of minor children who plan with us will have the peace of mind of knowing that their children will never be taken out of their homes in the event of an emergency and that a random judge will never decide who gets them long-term.

We also offer compassionate After-Life services, such as uncontested Probate and Trust Administration. We know from experience that most attorneys do not take the time required to truly help a family through this difficult process, so we decided to step in.

To learn more, schedule a free consultation today and learn how we will be there for your family today and tomorrow.

Watch our On-Demand Webinar

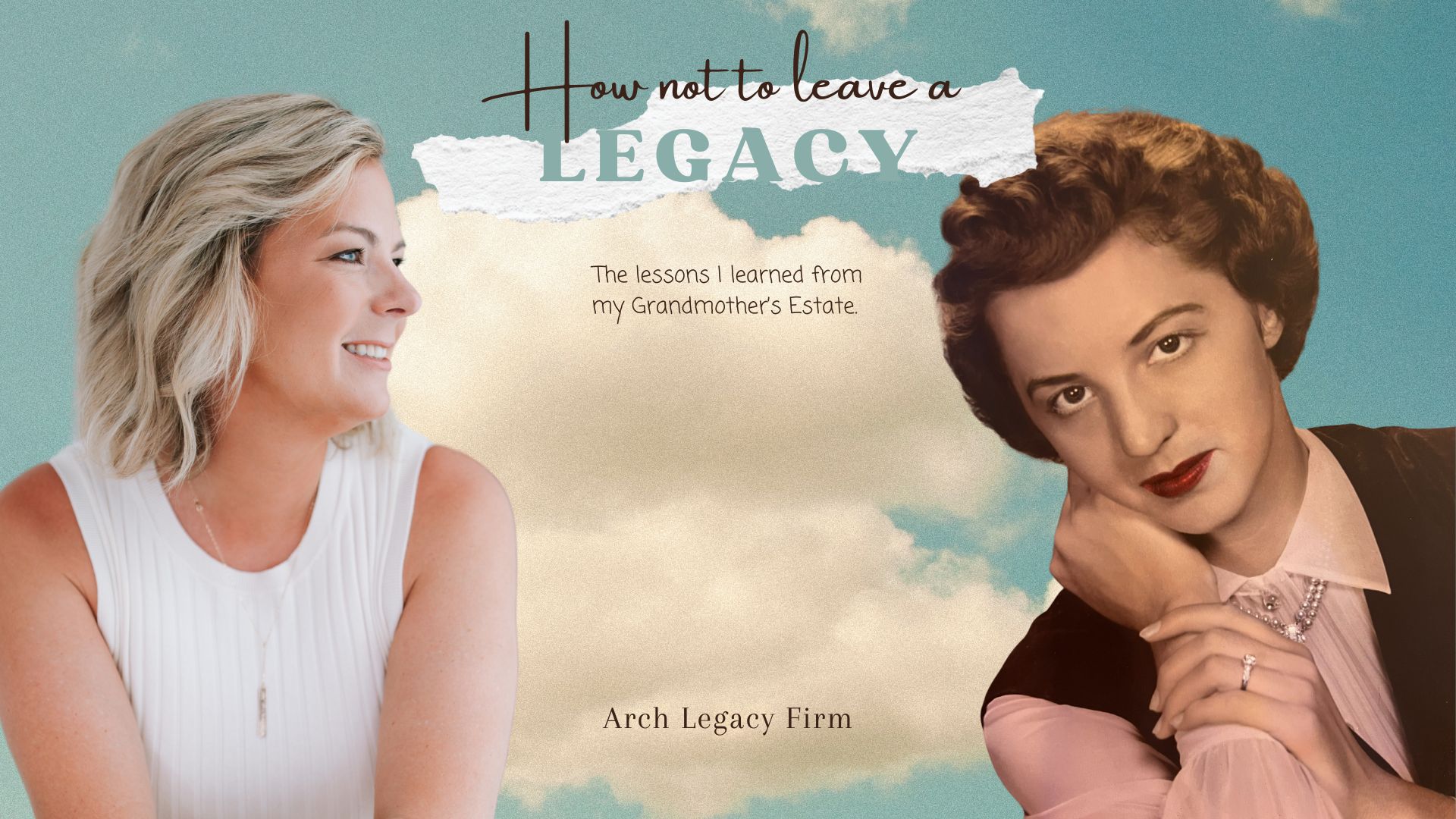

How NOT to Leave a Legacy

When Trish’s grandmother passed away, she learned a valuable lesson – that not all estate plans and attorneys are created equal. Join Trish in this quick 10 minute video to learn how you can protect your family from making the same mistakes.

How Can We Help You?

At Arch Legacy Firm, we are devoted to helping families protect their loved ones and career through a simple approach to estate and business planning. I look forward to meeting with you!

Wills & Trusts

Our goal is to help you understand the important differences between a “will” and a “trust” and about the other documents you will want to have in place to protect your family.

Planning for Parents of Minor Children

Although parents with young children often postpone Estate Planning until they have “more time” or “more money,” delaying can have disastrous consequences for your family.

Asset Protection Planning

Professionals must take steps to protect the personal assets they have earned through a lifetime of hard work. Let us help protect your hard-earned assets from divorce and creditors.

Estate Tax Protection

You work your entire life and hope to pass your assets on to your family. Estate tax is a tax paid on the net value of all your assets owned at your death. We can help you reduce – if not entirely avoid – the federal estate tax burden.

Special Needs Planning

Parents of children with special needs have additional financial, social, and medical factors to consider when Estate Planning. We can remove the fear and make it easy to understand and implement.

Business Planning

Ready to turn your business into your legacy? Let us help you solidify your legacy with personalized business succession planning and business consulting, ensuring that your business is set up for success and maximum growth.